Business protection is all about insuring you for the unexpected. Some will say “it is simply keeping your business safe should something go wrong”. Business protection can help ensure business continuity and allow the owners to maintain control whilst ensuring beneficiaries receive a fair value for their ownership/share of the business.

The number of private sector businesses in the UK at the start of 2023 was 5.6million businesses[1].

- 51 million businesses were small (0 to 49 employees)

- 36,900 businesses were medium-sized (50 to 249 employees)

- 8,000 businesses were large (250 or more employees)

Why have business protection cover?

Business protection arrangement will ensure that if people become ill or die. Your business

- Keep your business trading.

- Replace key individuals.

- Protect corporate debt.

- Buy out a shareholder or their estate should they become critically ill or die.

- Providing employee benefits to retain and recruit the best talents to help you grow.

Your business is yours and has its unique need. We can help as we have done for other businesses. Are you a sole trader, limited liability partnership, partnership or a limited company? It isn’t too late to consider business continuity.

Business continuity

Business continuity planning is the plan put in place by a business to make sure it could continue to trade if the unexpected happened. Many businesses look to protect themselves against every eventuality, buying insurance for their buildings, fixtures and fittings, stock, cars and materials. But the

majority don’t insure their single biggest asset – their key employees. What would happen if your business lost a key employee?

A key employee is someone whose death or disability would have a serious effect on the company’s ability to continue trading – for example a sales director who has valuable sales contacts, which might be lost if they died. To make sure the business can continue, the owners – who may be key to the business themselves – need to consider if their business:

- Could continue to trade, or would suffer financially, if it lost a key employee

- Do you have the necessary cash flow to replace any loss of profit or repay any outstanding loans, including directors’ loans.

The UK private sector comprises largely of non-employing businesses and small employers, as account for 99.9% of the business population. At the start of 2022

- There were estimated to be 5.5 million UK private sector businesses.

1.4 million of these had employees and 4.1 million had no employees.

74% of businesses did not employ anyone aside from the owner(s)

Business continuity planning may not be high on the priority list now. But it’s important you put plans in place to ensure you are protected. Having continuity plans in place can help you cover

- Cover any short-term loss of income/profit.

- Repay any outstanding loans.

- Repay any directors’ loans.

- Fund a permanent or temporary replacement employee.

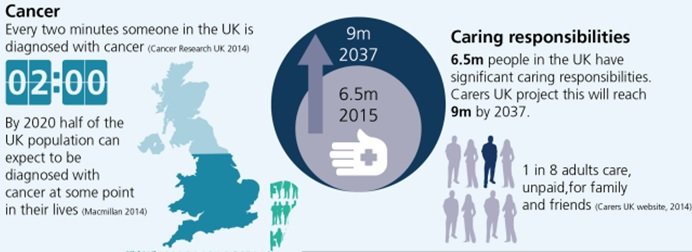

It is easy to assume this will not happen to me.

It may not happen to you but have you considered the implication should this happen to a loved one.

We can help. Please complete the below form and one of our corporate financial planners will be in touch

[1] Business population estimates for the UK and regions 2023: statistical release – GOV.UK (www.gov.uk)