In the UK, there are currently 900,000 people living with dementia in the UK and this is projected to rise to 1.6 million by 2040[1].

According to the National Health Service 438,213 patients had a recorded diagnosis of dementia on 28 February 2023, an increase of 6,368 patients since 31 January 2023.

62.0% of patients aged 65 or over who are estimated to have dementia, had a recorded diagnosis of dementia on 28 February 2023, an increase from 61.8% on 31 January 2023[2].

As part of a good financial planning process the need for clients building wealth or decumulating wealth. A key pillar is ensuring they have established a will or trust are in place whilst they have the mental capacity to do so. A Will

- Must be in writing.

- Must be signed.

- Must be witnessed (attestation)

- May be revoked & divorce cancels any benefit due to a former spouse under a will.

- Statutory wills – made by Court of Protection on behalf of someone lacking mental capacity who has no will (or it is contested or it needs to be changed, e.g. IHT planning).

According to a report from the National Will Register. Less than half of UK adults have a will. The report also found that 44% of UK adults had made a will, with men more likely to have made a will (50% of men; 39% of women) and more likely to discuss their estate with loved ones (62% of men; 55% of women)[3].

[1] Local dementia statistics | Alzheimer’s Society (alzheimers.org.uk)

[2] Primary Care Dementia Data, February 2023 – NHS Digital

[3] Two-fifths of UK adults not discussed instructions after death, new wills report finds | National Will Register

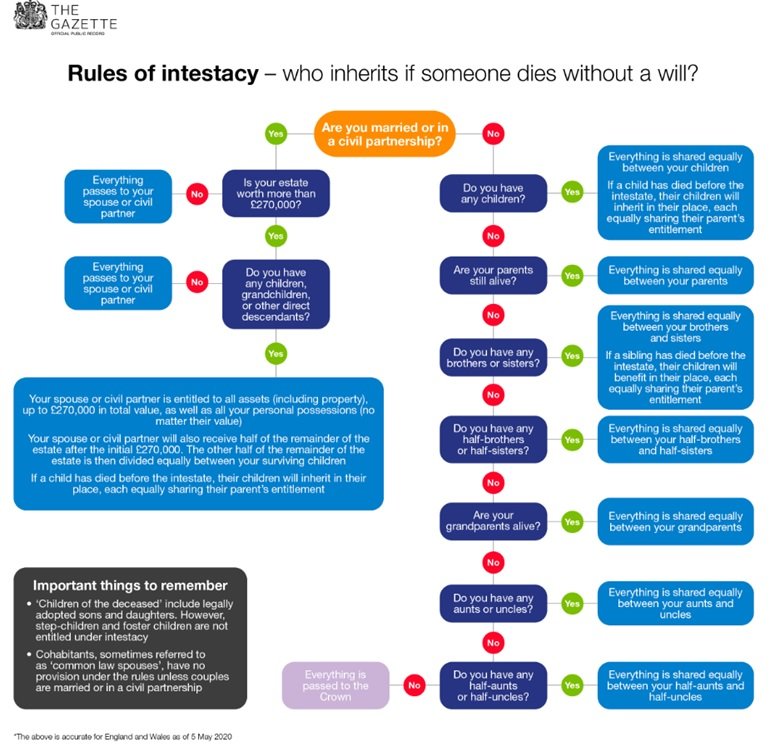

The consequences of not having a WILL

- Payment to your intended beneficiaries may be delayed.

Grant of probate (if there’s a will) or letters of administration (if there’s no will the law of intestacy will apply) is needed.

- Payment might not go to intended beneficiaries.

This could happen if there’s no will and the law of intestacy applies.

- Inheritance tax (IHT) may be payable if not written into a trust. (Own life, own benefits policies form part of the deceased’s estate).

- The policy won’t be protected from creditors.

Creditors can request the amount they’re owed from the deceased’s estate.

As an example for England and Wales

As part of the process of making a WILL. Your solicitors or financial practitioners may also ask you to consider putting in place a Power of Attorney or Lasting power of attorney.

Power of attorney is a legal document where one person (the donor) gives another person the right to make decisions on their behalf. If you want someone to act on your behalf in financial or medical decisions, you’ll need to give them power of attorney over your affairs. You can only set up a power of attorney while you still have the ability to weigh up information and make decisions for yourself, known as ‘mental capacity‘ – so it’s worth putting one in place early on.

Types of Power of Attorney

- Ordinary power of attorney (POA)

- Enduring power of attorney (EPA)

- Lasting power of attorney (LPA)

Of the above three. The most used one is the Lasting power of attorney (LPA). Many people arrange this while reviewing or revising their will, and you may be able to use the same service.

Property and financial affairs LPA

This gives your attorney the power to make decisions about your money and property, including:

- managing bank or building society accounts

- paying bills

- collecting a pension or benefits

- if necessary, selling your home.

Once registered with the Office of the Public Guardian, it can be used immediately, or held in readiness until you lose mental capacity.

Health and welfare LPA

This gives your attorney the power to make decisions about:

- your daily routine (washing, dressing, eating)

- medical care

- moving into a care home

- life-sustaining medical treatment.

It can only be used once you are unable to make your own decisions, though you will need to agree to it while you still have capacity.

According to a new report from the National Will register, report found that 44% of UK adults had made a will, with men more likely to have made a will (50% of men; 39% of women). Most likely to have discussed their estate with loved ones (62% of men; 55% of women).

A full report can be found at Two-fifths of UK adults not discussed instructions after death, new wills report finds | National Will Register. Do you need help with putting a WILL in place? speak to one of our financial planners