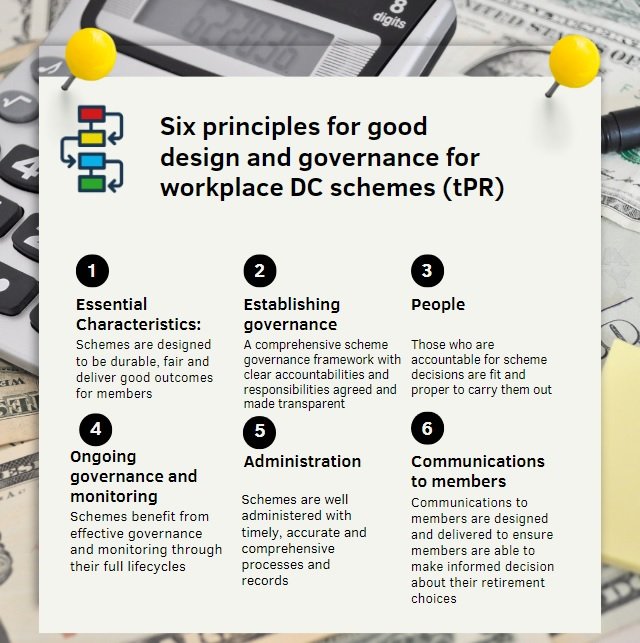

Principle 1: “Schemes are designed to be durable, fair and deliver good outcomes for members.”

This principle details the essential characteristics of a pension scheme and is focussed on members. Schemes should seek to offer flexible contribution structures as a way of being more engaging and attractive to members. The Regulator states that all members must receive value for money. Further, all members’ costs and charges, and their level of protection, must be clearly communicated. Upon retirement, there should also be a process in place which aims to help members to optimise their income.

Trustees should seek to mitigate the risks to members as far as possible, including investment risk. Investment options should be carefully considered, and objectives for each investment option should be identified and routinely reviewed.

Principle 2: “A comprehensive scheme governance framework is established at set-up, with clear accountabilities and responsibilities agreed and made transparent.”

The key features of this are accountability and the allocation of responsibility for the various elements of the running of the scheme. This will help to ensure a high level of quality. There must be ongoing monitoring of regulatory, financial, operational and compliance risks, and the suitability of investment options. Furthermore, the Regulator states that it is imperative that adequate resources and time are made available to carry out these tasks.

Principle 3: “Those who are accountable for scheme decisions and activity understand their duties and are fit and proper to carry them out.”

This principle concerns trustees and their administration of pension schemes: they must be fully aware of their duties and be capable of carrying them out effectively. All actions taken by trustees must be taken with the interests of all scheme members in mind and any conflict of interests must be managed effectively.

Principle 4: “Schemes benefit from effective governance and monitoring through their full lifecycle.”

The Regulator acknowledges the importance of ongoing monitoring. Trustees are obliged to demonstrate their continued capability to carry out their duties, and there should be procedures in place to assess the effectiveness and performance of services provided by scheme advisers. Importantly, the Regulator notes that trustees must take appropriate steps to resolve issues which put member benefits at risk such as late and inaccurate payments of contributions.

Principle 5: “Schemes are well-administered with timely, accurate and comprehensive processes and records.”

The Regulator states that member data across all categories must be accurate and subject to regular monitoring. Financial transactions should also be processed accurately. Further, any transactions should be dealt with in a timeous manner as members’ benefits are at risk of being affected if there is a delay. Another feature of this principle is that adequate business and disaster recovery arrangements must be put in place.

Principle 6: “Communication to members is designed and delivered to ensure members are able to make informed decisions about their retirement savings.”

The Regulator states that it is essential that members are kept informed at all times. This includes informing them on a regular basis of the relationship between the level of their contributions and the eventual size of their pension fund; and of the importance of regularly reviewing the suitability of their investment choices. Further, all member communications must be delivered in a clear and engaging way. Scheme trustees should take care that they in no way mislead members as this can lead to members taking decisions which adversely affect their pension benefits. The Regulator also states that there should be appropriate communication in place for the entirety of the member’s relationship with the pension scheme, from joining to retirement.

As can be seen above, the six DC principles cover a wide range of issues concerning the governance and administration of trust-based money purchase pension schemes. The principles lay the foundations for the new DC code and should guide trustees in carrying out their duties.

Do you need help with a new your scheme governance? Please speak to one of our corporate consultants