Around the world, individuals are being asked to take on greater responsibility for their own retirement. In the UK, the compulsion of auto-enrolling employees into a workplace pension arrangement and state funded pension may not be sufficient to live satisfactorily post-retirement. A reduction in the number of defined benefit (DB) employer plans which historically has been the primary source retirement income for many. This is causing individuals to make decisions they have never had to face when it comes to saving for retirement.

Many workers are disengaged from retirement planning during the early parts of their work life. An early working life is often characterised for many people as those years where they are.

- Paying off debts (student loans)

- Saving for a deposit for a property

- Active social life (holidays and event)

- Saving for a wedding

- Starting a family

Whilst all the above takes priority. We also know we should be saving for retirement, but we have less clarity on what that really means. Often, some of our clients don’t know how to set a realistic goal or how to get there.

Over the past two decades, the shift toward defined contribution (DC) plans as the primary vehicle for retirement savings has compounded this challenge. Our state pension benefits are typically communicated in terms of expected income during retirement. This makes it easier to comprehend. Unfortunately, defined contribution schemes often show a value of our fund that means little to the average person trying to understand how much he or she needs to save for retirement.

So, what represents a good retirement income? *Robert C. Merton is Distinguished Professor of Finance at MIT’s Sloan School of Management and University Professor Emeritus at Harvard University. No matter who is asking, I always give the same response: “An inflation-protected income that allows you to sustain the standard of living you enjoyed in the latter part of your working life throughout the rest of your life.” That is what you should be striving for with a retirement plan. 4 Ways to Improve the Probability of a Good Retirement (dimensional.com)

- Save more.

Ultimately, this means lowering your lifetime spending level, and likely, your standard of living. While it’s relatively simple in theory, it may be more complicated in practice.

- Work longer.

Opting to work longer can help in two ways. First, you may have the opportunity to save more. Second, you will have a shorter retirement period to support.

- Take more risks.

With less infringement on your current lifestyle, taking on more investment risk may seem like the way to go. But it’s important to have a backup plan. Don’t count on higher returns being a sure thing. Risk is real, and if taking risks is part of a solution, then one must be prepared for what to do if the risk is realized by, say, a big decline in stocks during retirement.

- Make the most out of assets available at retirement.

While the above strategies are driven by creating more assets, this fourth is about getting the most benefit from the assets you have at retirement time. By making an investment in an annuity instead of a bond, for example, you can “purchase” a larger set income for the rest of your life in return for giving up that income when you no longer need it.

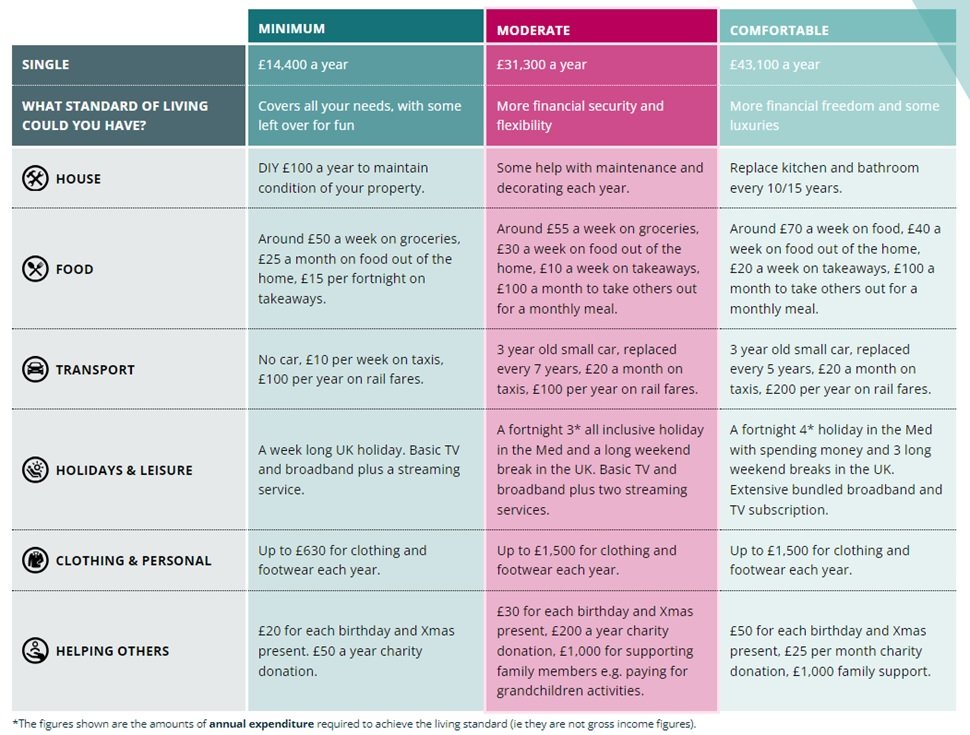

According to the pension and lifetime savings association as of 2023. Full report can be seen at Home – PLSA – Retirement Living Standards below is a table showing an individual with minimum spend will require £14,400 a year, moderate retirement is £31,300 a year and a comfortable retirement of £43,100 a year

Despite the fundamental shift over the past two decades in how people save for retirement, research shows that one of the best ways you can support an expected standard of living in retirement remains the same: Save early in your career, save more as your annual income increases, and build a framework to monitor your progress.

Do you know how much income you will receive in retirement based on your current fund value? For help and advice, please complete the link and one of our advisers will be in touch.