Small businesses are now required by law have to offer and contribute to workplace pensions for employees earning above £10,000 a year in the year, in practice that means pretty much every employee. For business owners, entrepreneurs or self employed what are the pension options you may wish to consider.

A personal pension arrangement

Personal pensions are pensions that you arrange yourself directly through a pension provider or a financial adviser. They’re sometimes known as defined contribution or ‘money purchase’ pensions. You’ll usually get a pension that’s based on how much was paid in. Some employers offer personal pensions as workplace pensions. The money you pay into a personal pension is put into investments (such as shares) by the pension provider. The money you’ll get from a personal pension usually depends on:

- Contributions made to the scheme. This could be your contribution, employer contribution or both.

- Investment returns as the fund value can go up as well as down.

- How you choose to draw the benefits.

A self-invested personal pension arrangement

A self-invested personal pension (SIPP) is a pension ‘wrapper’ that allows you to save, invest and build up a pot of money for when you retire. It is a type of personal pension and works in a similar way to a standard personal pension. The main difference is that with a SIPP, you have more flexibility with the investments you can choose. The wider investment options can allow you to invest in a wide range of assets, including:

- company shares (UK and overseas)

- collective investments – such as open-ended investment companies (OEICs) and unit trusts

- Investment trusts

- Property and land – but not most residential property.

A Small Self-administered scheme (SSAS)

SSAS is a type of pension, usually a defined contribution workplace pension, that can give extra investment flexibility. This can be independently managed by the company that sets it up. It doesn’t require any interaction with financial institutions or insurance companies and is usually set up by directors and senior staff. SSAS can provide increased retirement benefits and greater investment flexibility. Members of an SSAS pension can choose how their pension savings are invested and can use their SSAS pension to invest in the company.

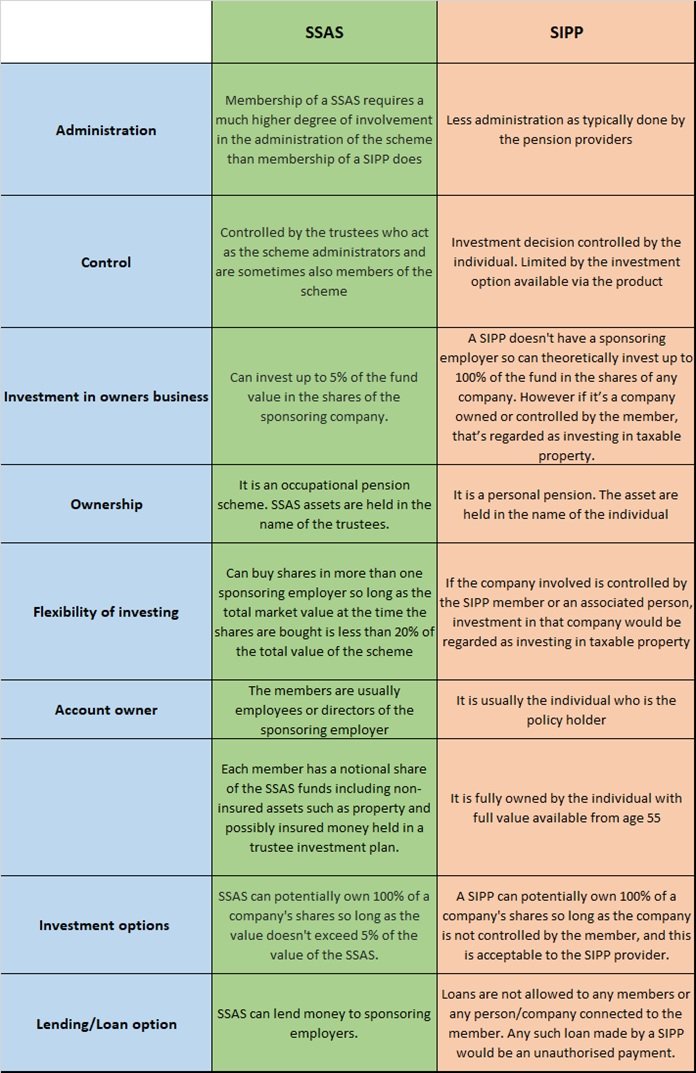

How does a SIPP compare to a SSAS

Do you need help setting up a personal pension or a company pension scheme? Speak to one of our financial planners.