Have you heard this phrase TANSTAAFL, TINSTAAFL or TNSTAAFL which means There ain’t no such thing as a free lunch, or There is no such thing as a free lunch. A phrase coined in the 1930’s communicating an idea that it is impossible to get something you value for nothing. In this series we explore the notion of cash vs investment, interest vs returns and when best to hold cash.

We are now entering a whole new investing environment and facing new challenges when it comes to long term investment. We have seen how popular savings account have become with the opportunity to save and benefit from higher interest rate. Common questions are ‘is it time to get out of the stock market given all the apparent risks?’ and ‘should I be investing in cash, now it’s made a triumphant comeback as an income providing asset class?’

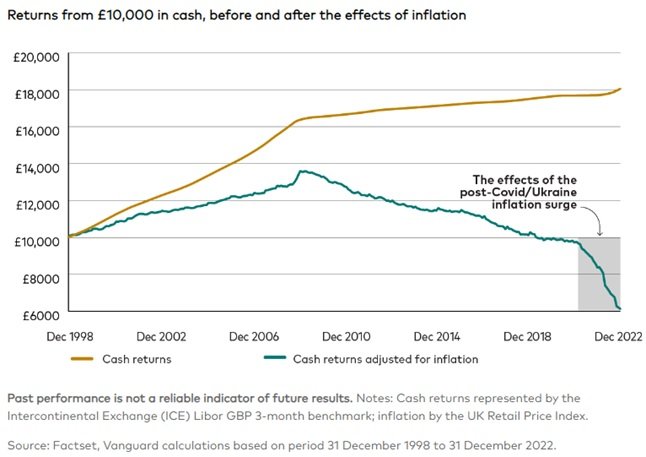

For anyone with a long-term investment time horizon the answer is likely to be ‘hold your nerve’. The key operating word here is “long-term” and if looking to invest on a shorter term basis then the answer is simply stay in cash. The below example is showing cash return which looks attractive but when adjusted for inflation (the true purchasing power of your £10,000 is now £6000)

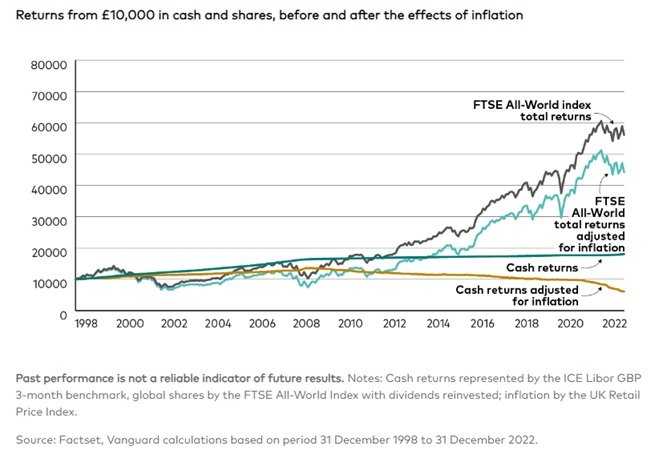

This compared to investing in the FTSE world index and adjusted for inflation tells its own story

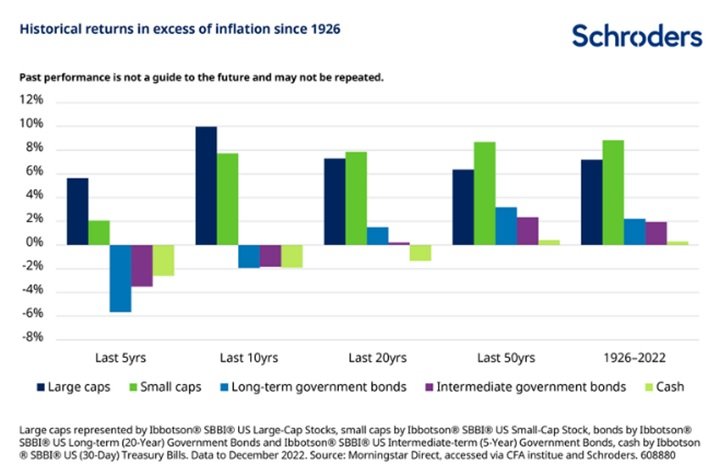

How well as cash returns and market return have performed against inflation.

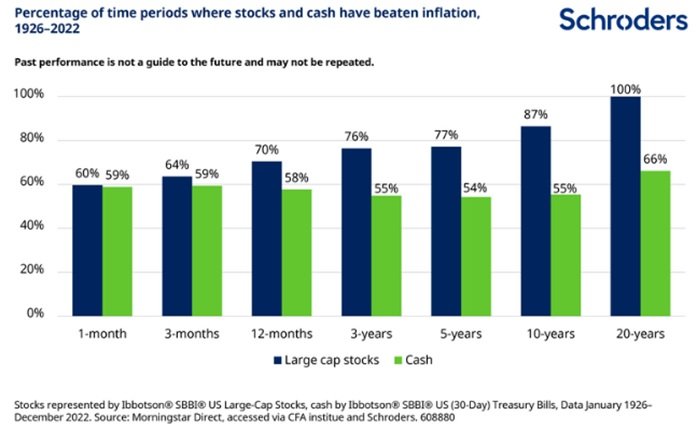

History tells its own story.

Cash we believe has a role to play in your portfolio. Is cash the right option for long term investment?

To learn more on how we can help. Please speak to one of our financial planner