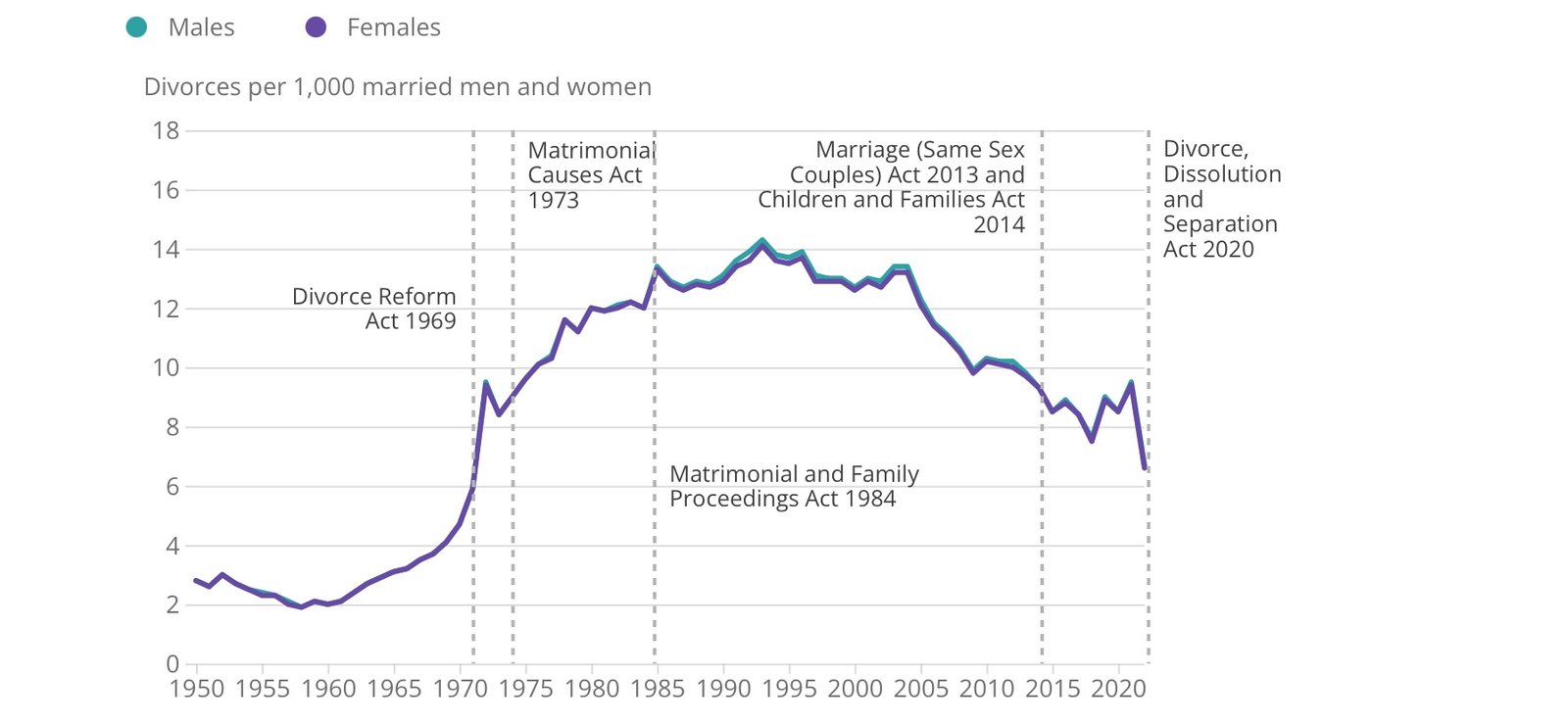

The office of National Statistics (ONS) recent published its divorce rate numbers in 2024. There were 80,057 divorces granted in England and Wales in 2022; a 29.5% decrease compared with 2021 (113,505 divorces) and represents the lowest number of divorces since 1971.

Some of the reasons for divorce

- Unreasonable behaviour has also been the most common ground.

- Two-year separation

- Adultery

The Divorce, Dissolution and Separation Act 2020 came into effect on 6 April 2022. Before this, a petitioner or applicant had to prove one or more Facts (including unreasonable behaviour, desertion, separation, either with or without consent of the respondent and adultery) to establish the irretrievable breakdown of the legal partnership.

Three broad ways of splitting pension asset after a financial order has been put in place. They are offsetting, Pension sharing and earmarking orders. It is important to understand the advantages and disadvantages of each approach. Let us take a look at each in more details.

Pension Offsetting

This means you trade a right to receive a pension benefit now or in the future for an asset you can have now. For example, your ex might keep all of their pension fund, and as a trade-off you get more of a share, or all of the family home.

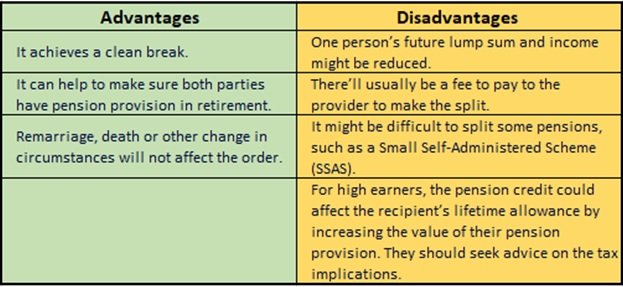

Pension Sharing Order

A judge has the power to make an order to share out your pension savings between you. This order is called a pension sharing order. A pension can only be shared if a court order on divorce has been made by a judge. A pension sharing order tells the providers of a pension fund to transfer a percentage of the transfer value (anything up to 100%) to whichever one of you is to benefit from the order.

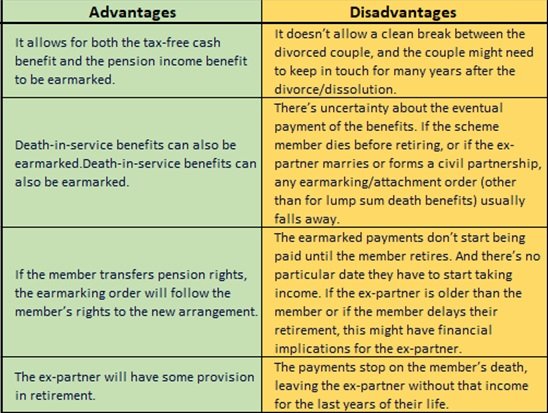

Earmarking order

An order that the judge can make is a pension attachment order. Under this order a percentage of your pension that you get, each week or month, is paid to your ex, or a percentage of theirs is paid to you. A percentage of any tax-free lump sum you receive from your pension can also be paid to your ex, or the other way round. The same approach can be used when it comes to any death in service benefits too, so that if you die in service, a percentage of that benefit is paid to your ex, or a percentage of theirs is paid to you.

What about pensions that are already paying out?

Pension sharing is also available from schemes where pensions are already in payment, although the process is more complicated, and advice will be required in this area. To learn more speak to one of our financial planner