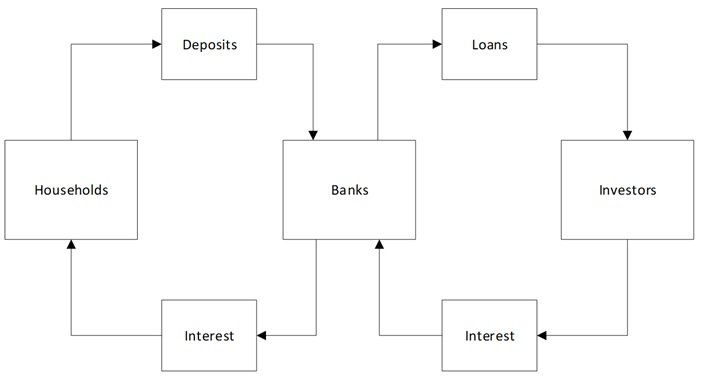

Cash is the investment placed into a savings account. A savings account is simply an account for you to put money in and earn interest.

How does it work?

Savings account as an investment vehicle

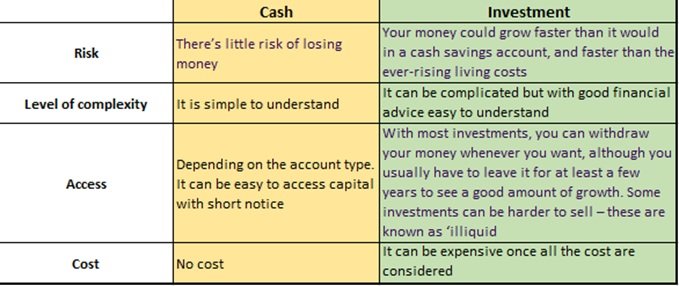

Money placed in a deposit investment will grow, provided the accrued interest is not withdrawn, because the retained interest becomes part of the capital and also earns interest. If the return over and above the rate of inflation is withdrawn, then, in real terms, the capital will maintain its value. Generally, if the objective of the investment is growth, alternatives to deposit-based investment should be considered.

Savings interest is paid tax-free and most won’t pay any tax on it at all. However, a basic-rate taxpayers can earn £1,000/year tax-free and higher-rate taxpayers £500.

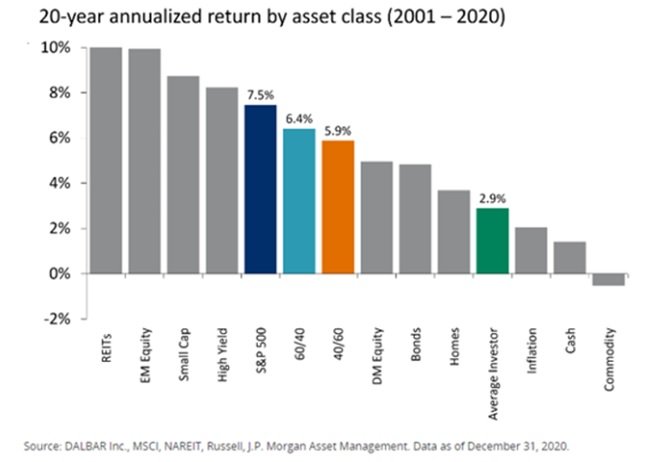

Despite the short-term attractiveness of cash. It’s prudent to remember the actual historical returns of other asset classes compared to cash.

The key issue here is the impact of inflation on cash. Inflation is the rate that prices for goods (clothes, food, travel) and services (broadband, mobile contracts) go up. Inflation fluctuates and if it’s high, the interest rate on your cash savings account in most cases won’t keep up with it.

The worth of your money or buying power actually decreases – even if your cash savings account balance is going up. As an example

Adam is a basic rate taxpayer with £25,000 saved in his account since July 2021. He has enjoyed a rate of interest of 6% per annum. His total interest accrued is £3178.99.

His current account balance and buying power of his investment is £28,178.99.

For his savings to keep pace with inflation over the two years of investment. The bank of England inflation rate calculator https://www.bankofengland.co.uk/monetary-policy/inflation/inflation-calculator

Same Goods and services he can purchase in 2021 for £25,000 would now cost him in 2023, £29,337.61. He would need a rate of interest of 8.026% for his money to be worth the same as it was two years previously.

Are you unsure about investing? Sat in cash and need help. Speak to one of our financial adviser