Bank of England have raised interest rate thirteen times since the start of 2022

It is important that savers understand there are many excellent reasons to be holding cash. But just because savings rates are rising does not mean cash is keeping pace with inflation or a better option when compared to equities over the longer term.

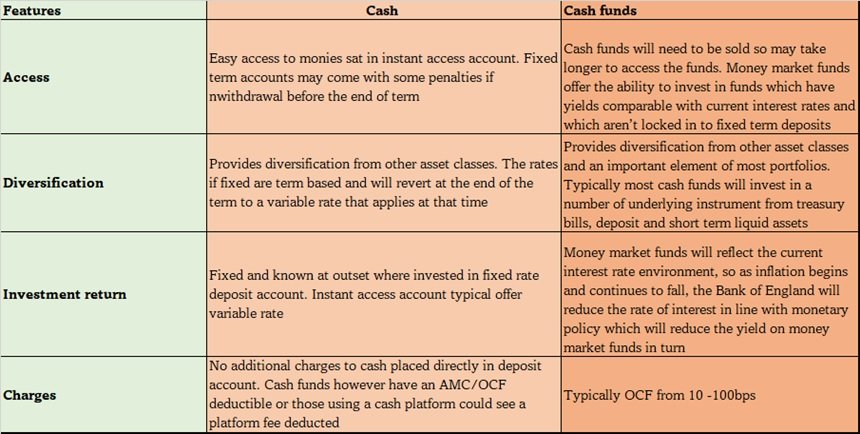

Cash funds typically invest in money market instruments, such as treasury bills, deposits, and other short-term liquid assets. Some of these can be lent and borrowed to satisfy the cash flow requirements of banks and other institutions for the short term. Cash fund is a lower risk investment type this doesn’t mean there is no investment risk when compared to that of bank deposit accounts. Cash funds may also contain derivatives that could increase the relative risk factor of the fund and the risks to the investor. Here are some of the differences between cash and a cash fund.

Both cash and cash fund have one kryptonite which is “inflation”. Inflation is a measure of how much the prices of goods (such as food or televisions) and services (such as haircuts or train tickets) have gone up over time. Usually, people measure inflation by comparing the cost of things today with how much they cost a year ago. The average increase in prices is known as the inflation rate. An example on the impact of inflation as of November 2022

With cash earning 5%, why risk money on the stock market? (schroders.com)

UK inflation as of July 2023 is 6.7%. This should be factored in when considering the impact on returns from investing in fixed deposit accounts. Cash deposits and money market instruments provide a low-risk way to produce an income or capital return. They also allow the investor to preserve their nominal value of the amount invested, i.e excluding the effect of inflation. These assets also play a key role in times of market volatility or uncertainty, because they have no underlying market exposure so they are, ordinarily, a low-volatility asset class

Do you need help with investing your cash? Speak to one of our financial planner