According to the FCA, regulated advice includes any communication with the customer which, in the context in which it is given, goes beyond the mere provision of information and is objectively likely to influence the customer’s decision whether to take an action, buy or sell. In a world full of bad actors, the challenge is ensuring you are informed and understand the level of protection you receive when you receive advice from a regulated adviser.

According to the FCA, regulated advice includes any communication with the customer which, in the context in which it is given, goes beyond the mere provision of information and is objectively likely to influence the customer’s decision whether to take an action, buy or sell. In a world full of bad actors, the challenge is ensuring you are informed and understand the level of protection you receive when you receive advice from a regulated adviser.

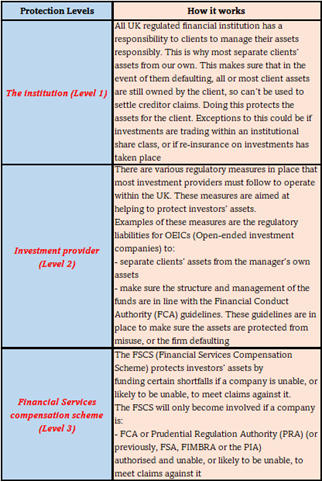

There are three levels of protection.

Investment provider or fund manager

With many investments, the legal structure required to manage the investment ensures greater protection of clients’ assets, such is the case with collectives that operate in line with the Financial Service and Markets Act 2000 (FSMA). Collective fund schemes have a responsibility to appoint a depositary who is independent to the fund’s board or the fund’s authorised corporate director. The depositary is responsible for ensuring the assets are segregated from the fund manager’s own assets and oversees the safe custody of these assets.

Unit trusts appoint a trustee who has similar responsibilities to that of a depositary for a collective and who’s responsible for ensuring the fund manager keeps to the fund’s investment objective and safeguards the trust’s assets.

The Financial Service compensation scheme

The FSCS is an independent body set up under the FSMA. The FSCS deals with claims against authorised firms regulated by the FCA or PRA. This usually happens because a firm has stopped trading and doesn’t have enough assets to meet claims or is in insolvency. This is described as in default. The primary role of the FSCS is to protect policyholders. They work with insolvency practitioners, responsible for the ongoing administration of the firm and the settlement of claims, to determine their involvement to make sure that policyholders have clear instructions on how to make a claim, and what to do if they need immediate assistance.

- The FSCS can also provide funds to meet protected claims. This can include returning premiums if a firm is unable to. In some cases, funds from the insolvent firm may be available to pay some of the amount due to a client. If the amount paid is less than the FSCS compensation limit, then the client can make a claim on the FSCS for compensation for the balance in line with the FSCS compensation rules.

- The FSCS can also try to arrange (or help with) a transfer of some of the business to other providers if this is cost effective and practical.

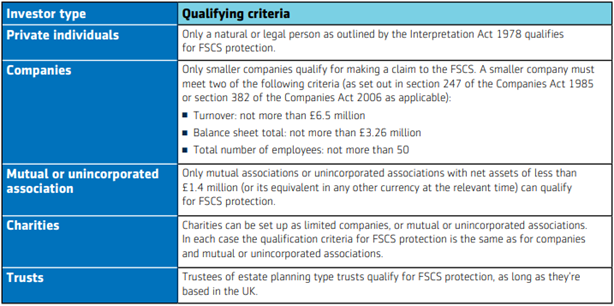

Who can claim?

The table below provides a summary of who can make a claim. Overseas financial services institutions and large companies can’t make claims.

The full details of eligible parties to compensation can be found at https://www.handbook.fca.org.uk/handbook/COMP.pdf