Life expectancy has increased over time and is projected to continue to do so. Life expectancy has increased by 10 years for male and females as of 2020 compared to 1951 according to the report provided by the office of National Statistic in Life tables and principal projection report.

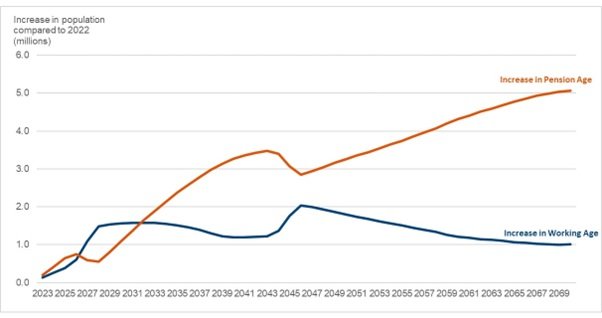

There were 280 pensioners for every 1000 people of working age as of 2020. This will increase rapidly from the 2030s and will reach levels never seen before by 2070, where the ratio is projected to be 393 pensioners per 1,000 people of working age. in the light of the significant change in the UK economy in recent times and the impact on the public finances of heightened global volatility.

It has now become important for each individual to begin the process of planning for their own retirement outside of the state support.

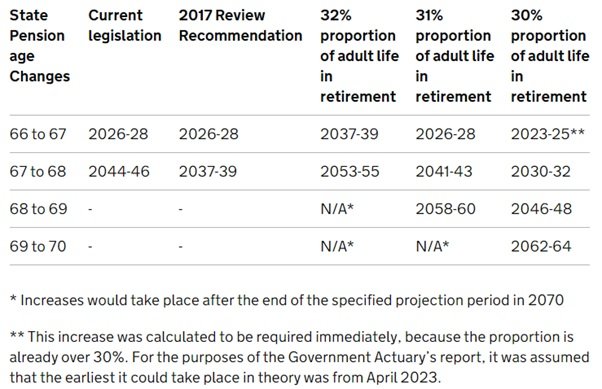

The current UK retirement age is 66 and will gradually start increasing again from 6th of May 2026

Eligibility criteria

You’ll be able to claim the new State Pension if you’re:

- A man born on or after 6 April 1951

- A woman born on or after 6 April 1953

The earliest you can get the new State Pension is when you reach State Pension age.

Your National Insurance record

You’ll usually need at least 10 qualifying years on your National Insurance record to get any State Pension. They do not have to be 10 qualifying years in a row.

What you’ll get where you have the full contributory record

The full State Pension is £203.85 per week or £10,600 a year

You can get more than the full State Pension are if:

- you have over a certain amount of Additional State Pension

- you defer (delay) taking your State Pension

To check your forecast

Check your State Pension forecast – GOV.UK (www.gov.uk)

Check your State Pension forecast – GOV.UK (www.gov.uk)