A trust is a way of managing assets (money, investments, land or buildings) for people. There are different types of trusts, and they are taxed differently. Your personal circumstances and objectives will determine the best type of trust. See our trust decision tree Trust – Choosing the right option for more information.

Trusts typically involves three categories of people.

- The ‘settlor’ – the person who puts assets into a trust.

- The ‘trustee’ – the person who manages the trust.

- The ‘beneficiary’ – the person who benefits from the trust.

Why would you want to put a TRUST in place?

- To pass assets to the next generation in a controlled way.

- Tax planning exercise.

- To manage assets on behalf of young or vulnerable beneficiary(ies).

- Speed of access, as no Grant of Probate required.

- Can also help to protect the trust assets in the event of divorce or

- means testing.

As a trust is a legal arrangement for managing assets. It is important to seek advice before establishing a trust as this could be irreversible once established.

How is a trust created?

Trusts can be created in a number of different ways. It could be created

- By Deed

- By a Will

- By a Deed of variation

- By operation of the law example statutory trust

- on intestacy

- Verbally

- An example can be a parent opens a building society account for a minor.

Rules for a trust to be valid – three test of certainty

- Certainty of settlor’s intention to create the trust.

- Certainty over trust objects i.e. beneficiaries

- Certainty over trust subject i.e. asset that is subject to the trust.

The asset must be successfully transferred into the hands of the trustees.

Who manages the asset?

The trustees are responsible for managing the assets in a trust and fulfilling the purpose of the trust. The role of a trustee carries a lot of responsibility. It’s important you get advice from a solicitor before agreeing to be a trustee. Trusts and taxes: Trustees – tax responsibilities – GOV.UK (www.gov.uk)

- Trustees must be willing to put in the time and effort necessary to make sure that the settlor’s wishes are carried out, and that the assets are managed for the beneficiaries.

If you’re asked to be a trustee, talk to the settlor about their expectations of you, and who the other trustees are (you’ll be expected to work with them in the future to manage the trust). Putting a WILL in place is a form of a trust.

Importance of a WILL

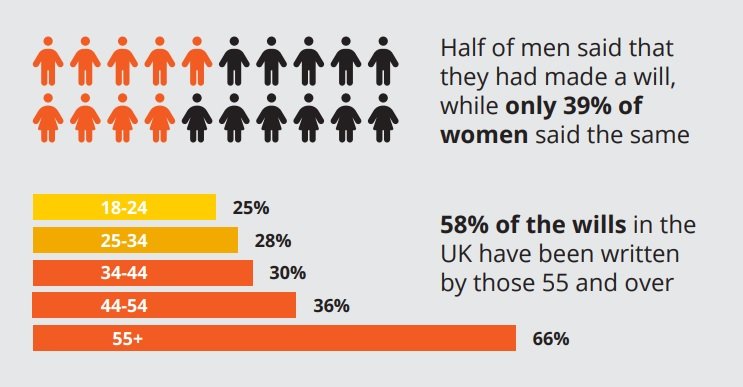

According to the National Wills register in 2023. 44% of UK adults have made a will. This equates to around 23.75 million wills and is a similar figure to previous surveys in the industry such as Canada Life in 2022. The majority of wills (58%) have been made by those over the age of 55, with two-thirds of that age group having made a will. Only 30% of people under 55 have made a will. There is also a noticeable gender wills gap between men and women as to making a will, with half of men saying that they have made a will while only 4 in 10 women (39%) saying the same.

Why put a will in place

- To name executors, who will administer deceased’s estate.

- To set out who is to benefit from the assets in the estate.

- To appoint a guardian for children.

- Can set out the age that beneficiaries should inherit.

- Saves time, money and stress for loved ones.

What happens if a minor is a beneficiary under the terms of a will?

Someone under 18 (16 in Scotland) lacks the capacity to receive and accept a gift. Trustees would be appointed in the will and could contain the option for payment to be made to the guardian(s) of the minor. If the minor is to benefit but there is no trust in the will, assets will automatically be held in trust until the beneficiary reaches 18 (16 in Scotland). It could contain express trust provisions with assets being held in trust until the age specified example 18, 21 or 25.

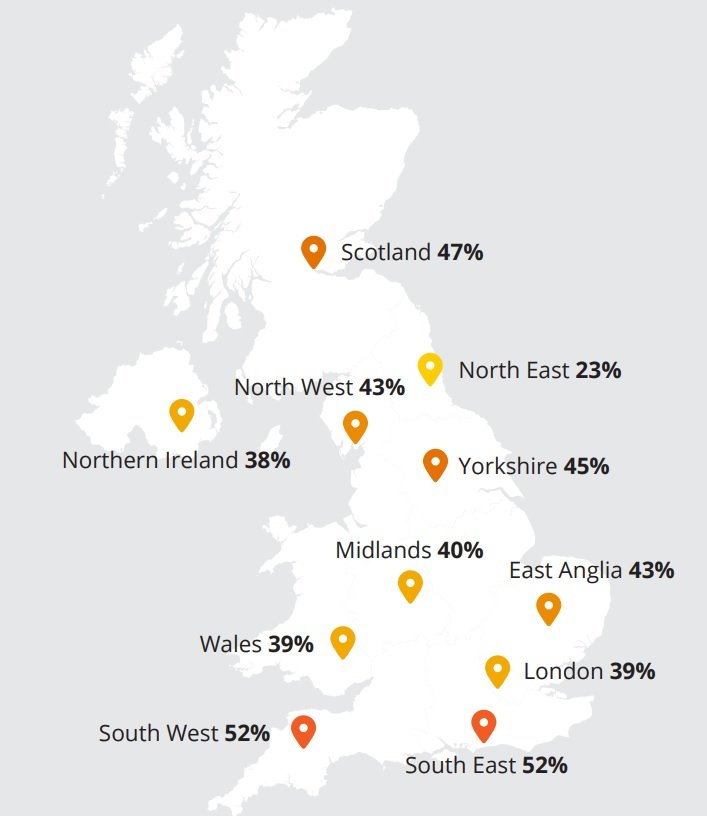

Those in the South are most likely to have a Will, while less than a quarter of adults in the North East have a WILL. Do you need help? Please complete the form below to speak to to one of our financial planners